QuickVUE™: Revolutionizing Property Inspections

Workflows that Work for You

QuickVUE helps you “set it and forget it,” automating your policy renewal workflows from start to finish.

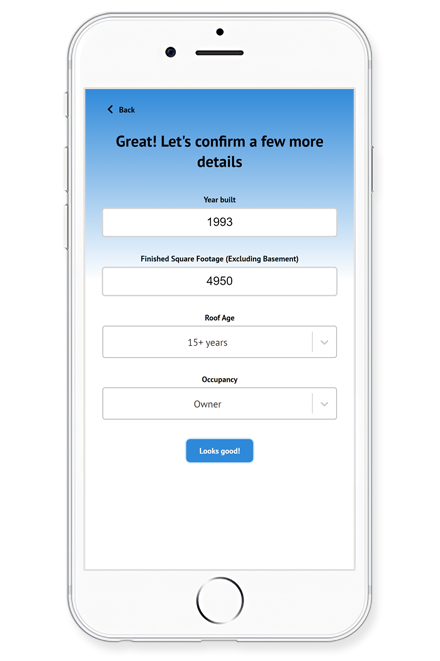

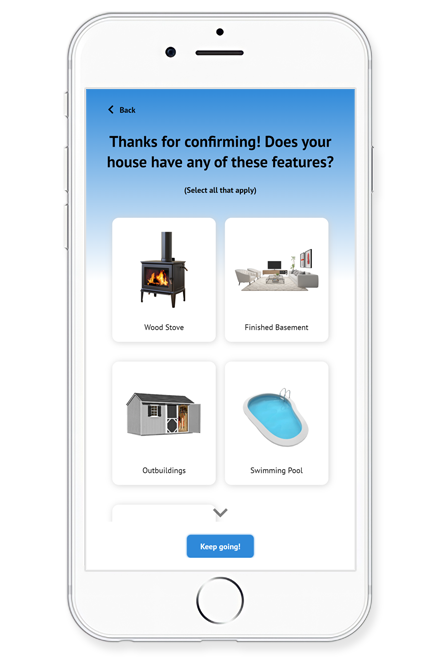

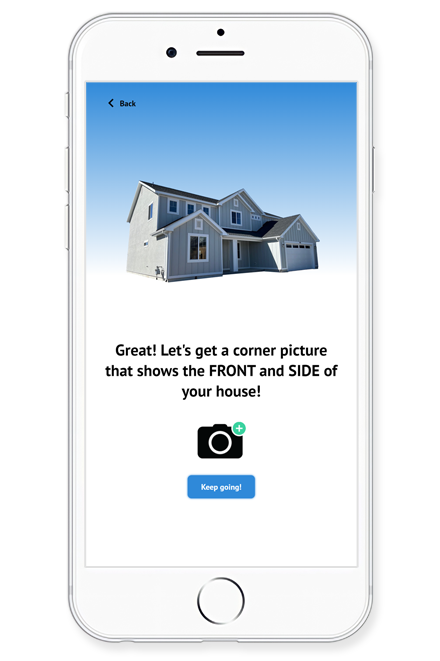

- Get rich data

- Validate it through remote property assessment

- Get boots on the ground, only when absolutely needed

- Gain actionable risk insights

- Boost your bottom line

JMI Reports: Protecting Your Blindside

JMI Reports is a risk innovator providing property profiles and data insights to improve efficiencies and profitability for insurance carriers and MGAs. For more than 30 years, our mission has remained the same: to protect your blindside by listening to your needs and by delivering actionable, forward-thinking, and cost-saving solutions that make a difference.